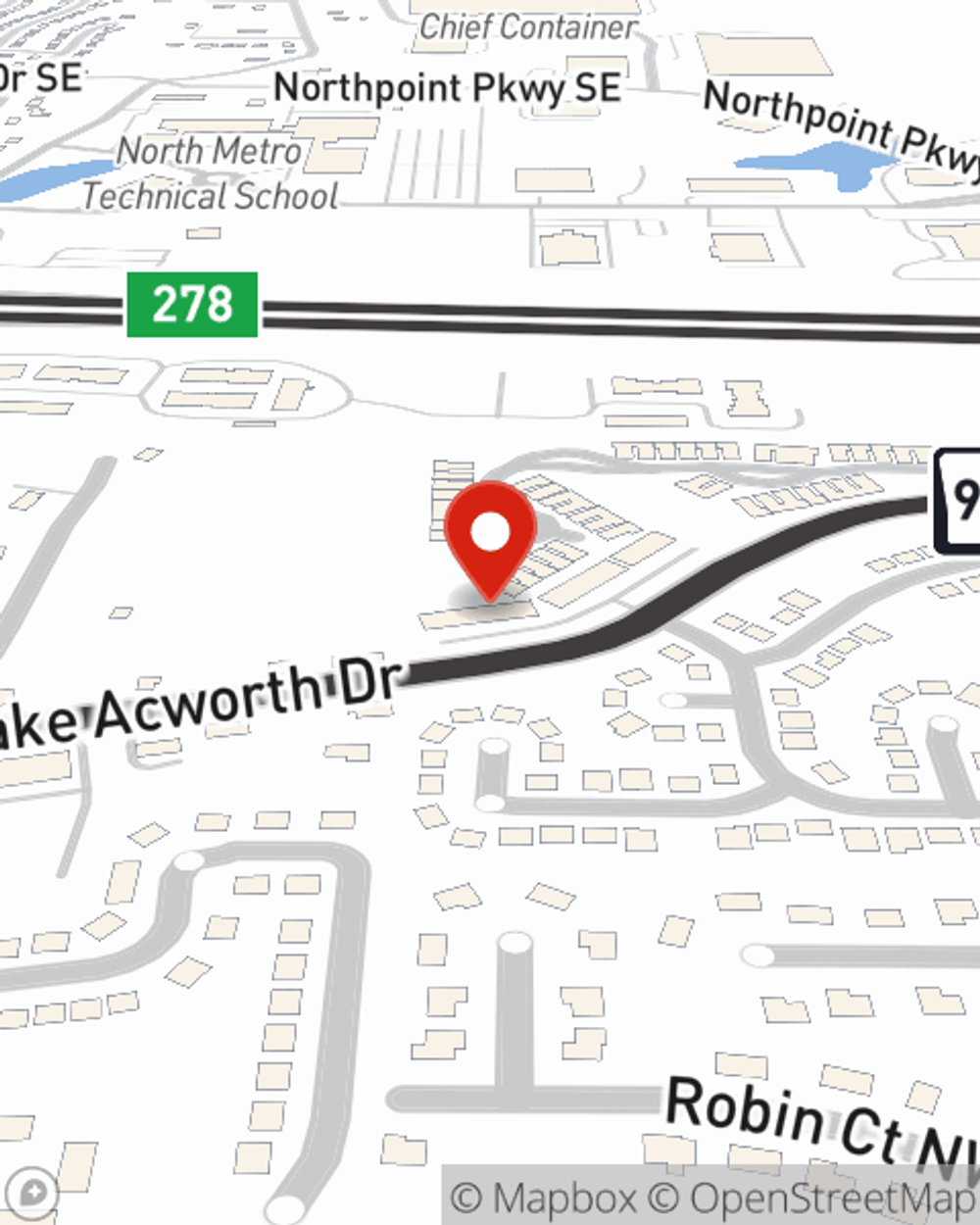

Business Insurance in and around Acworth

Calling all small business owners of Acworth!

This small business insurance is not risky

Cost Effective Insurance For Your Business.

Being a business owner isn't easy. You want to make sure your business and everyone connected to it are covered in the event of some unexpected accident or mishap. And you also want to care for any staff and customers who get hurt on your property.

Calling all small business owners of Acworth!

This small business insurance is not risky

Insurance Designed For Small Business

With options like business continuity plans, errors and omissions liability, extra liability, and more, having quality insurance can help you and your small business be prepared. State Farm agent Barry Nash is here to help you customize your policy and can assist you in submitting a claim when the unexpected does arise.

Don’t let concerns about your business stress you out! Reach out to State Farm agent Barry Nash today, and see the advantages of State Farm small business insurance.

Simple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Barry Nash

State Farm® Insurance AgentSimple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?